Most talent teams track activity, but elite teams measure the direct impact of talent strategy on revenue and competitive advantage.

Shifting focus from operational metrics like time-to-fill to strategic indicators like Quality of Hire, High-Performer Retention, and Internal Mobility transforms TA from a cost center into a core business driver.

TL;DR: Stop Tracking Noise

- Ditch Vanity Metrics: Move beyond simple activity tracking like time-to-fill. Focus on strategic talent management metrics that connect directly to business outcomes like revenue, innovation, and market share.

- Focus on the Four Pillars: Structure your measurement around Acquisition (Pipeline Velocity), Performance (Quality of Hire), Retention (High-Performer Turnover), and Development (Internal Mobility Rate).

- Quality of Hire is King: This is the ultimate metric for proving recruiting ROI. Create a weighted formula combining post-hire performance, manager satisfaction, and retention to quantify the impact of new hires.

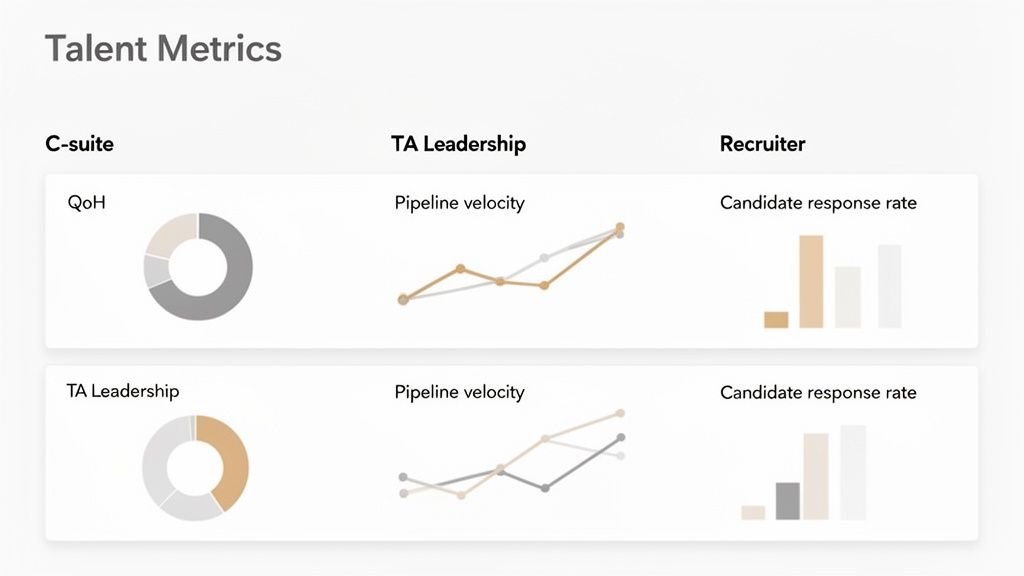

- Tailor Your Dashboards: Don't use a one-size-fits-all approach. Build separate dashboard views for the C-Suite (strategic ROI), TA Leadership (operational efficiency), and individual recruiters (tactical actions).

Most talent teams are laser-focused on operational numbers like time-to-fill. While that’s an important piece of the puzzle, it only tells you about activity, not business impact. Elite teams know the difference.

The best talent management metrics flip the script. They shift the focus from simple activity tracking to strategic outcomes that directly boost revenue, drive innovation, and improve the long-term health of the organization. Instead of just reporting on how fast you can hire, you start telling a compelling story about how your talent strategy creates undeniable value.

This shift is what earns you a seat at the executive table and proves the ROI of your team's hard work. By mastering a few select metrics—Quality of Hire, High-Performer Retention, and Internal Mobility—you can build a data-driven narrative showing how your talent decisions create a real competitive advantage.

What Are the Four Pillars of Strategic Talent Measurement?

A random list of recruiting KPIs is just noise. A truly powerful talent metrics framework tells a story about your entire talent lifecycle.

By breaking things down across four distinct pillars—Acquisition, Performance, Retention, and Development—you can finally stop tracking busy work and start showing real, strategic impact. This approach makes it crystal clear how each phase, from outreach to leadership training, actually fuels business outcomes.

Pillar 1: Acquisition

This first pillar measures the speed and intelligence of how you bring new talent into the fold. Sure, Time-to-Fill is a classic, but the best teams dig much, much deeper.

Here’s what really matters in acquisition:

- Pipeline Velocity: How long are candidates stuck in each stage of your hiring process? A slowdown here could mean your assessment process is a bottleneck or your interviewers need better training. It's the first sign of friction.

- Source of Hire Effectiveness: This isn't just about where hires come from; it's about where your best hires come from. Are referrals outperforming job boards? This metric tells you where to double down on your sourcing budget and effort. For a closer look at tools, see our list of candidate sourcing tools.

- Offer Acceptance Rate: Calculated as (Offers Accepted ÷ Total Offers Extended) x 100, this is your reality check. A low rate is a massive red flag that your compensation, benefits, or employer brand isn’t hitting the mark.

Pillar 2: Performance

Once you've made the hire, the focus pivots to their actual impact. Performance metrics are the bridge between your hiring decisions and tangible business results. They're how you prove the TA function's value. The undisputed champion here is Quality of Hire.

Quality of Hire (QoH) is the clearest indicator of recruiting ROI. It blends pre-hire data like assessment scores with post-hire outcomes like first-year performance ratings and manager satisfaction to create a holistic view of a new employee's success.

Improving QoH isn’t magic; it’s a data-driven feedback loop. When you see that new hires from employee referrals consistently knock their performance reviews out of the park, you know exactly where to invest more time and resources.

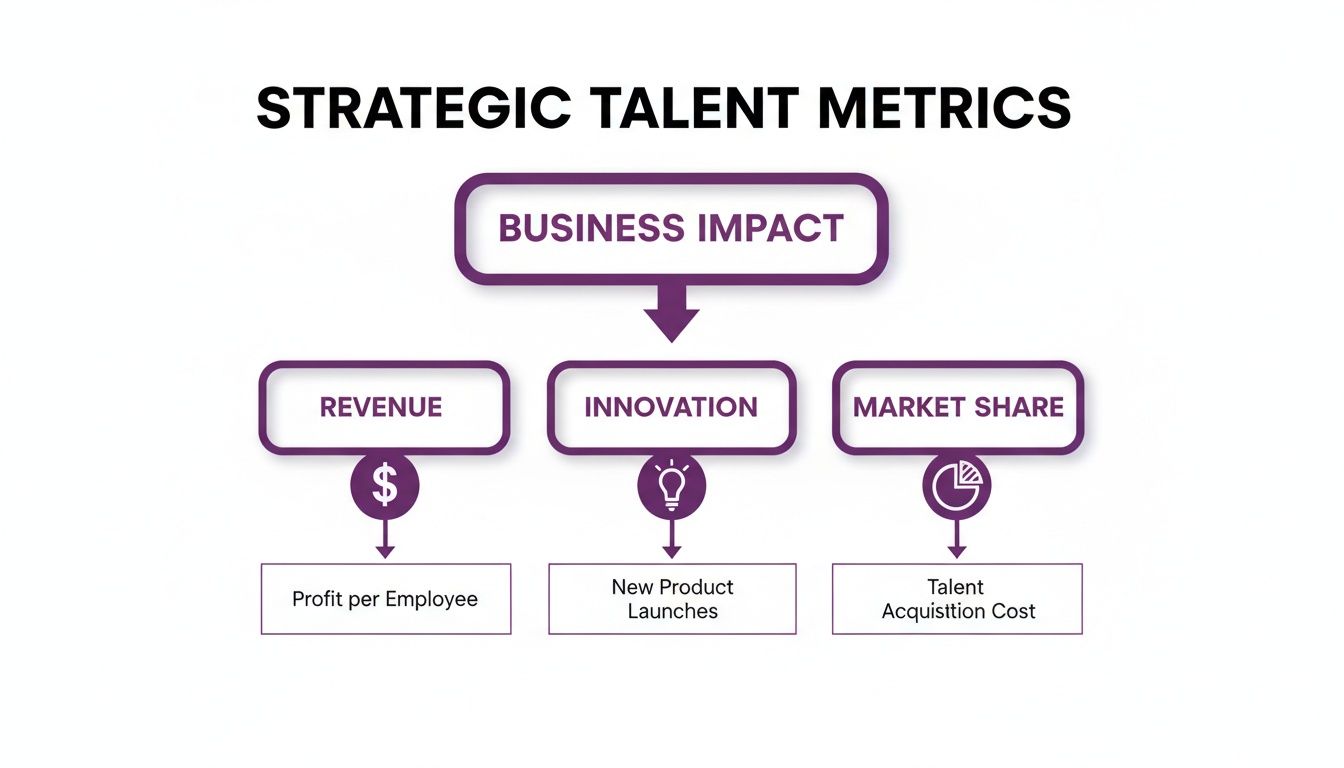

The infographic below shows how these strategic metrics connect directly to the things your CEO actually cares about: revenue, innovation, and market share.

It’s a powerful reminder that tracking metrics in a vacuum is pointless. The goal is to draw a straight line from your talent activities to measurable business growth. To give you a clearer picture, let's map these concepts out.

Pillar 3: Retention

Hiring and training top talent is an expensive, time-consuming investment. The Retention pillar measures how well you protect that investment. Simply looking at your overall turnover rate won't cut it.

The retention metrics that provide real insight are:

- High-Performer Turnover: Often called regrettable turnover, this tracks the voluntary exit rate of your top talent. Losing even a handful of these folks can have an outsized, negative impact on everything from innovation to team morale.

- First-Year Attrition: What percentage of new hires are walking out the door within 12 months? A high number here suggests a major disconnect between what you promise in the hiring process and the day-to-day reality of the job. You can dig deeper into more granular recruiting metrics to diagnose exactly where things are going wrong.

Pillar 4: Development

The final pillar answers a critical question: how well do you grow your own talent? A strong internal development program is the secret to building a sustainable leadership pipeline, keeping people engaged, and slashing recruitment costs for senior roles.

The key metric here is the Internal Mobility Rate (IMR), which tracks the percentage of jobs filled by your own people.

This focus on internal growth is more critical than ever. The current talent market is all about movement, with a staggering 44% of professionals globally expecting to change roles within a year, according to ACCA's 2023 report. This trend makes it crystal clear: a competitive advantage isn't just about offering a job anymore. It's about showing a real commitment to career progression and development. Read more on the latest global talent trends.

A healthy IMR sends a powerful message to employees that they have a real career path inside the company, making them far less likely to jump ship for their next opportunity.

How Do You Calculate Quality of Hire?

If there's one metric that truly connects a recruiter's work to the company's bottom line, it's Quality of Hire (QoH). While most teams are busy tracking things like time-to-fill, QoH is what proves the real value of a new hire. It shifts the conversation from "how fast did we hire?" to "how much impact did this hire make?"

Most TA dashboards skip it because it feels too complex or subjective. The trick is to stop thinking of it as a "feeling" and start treating it like a data-driven index. By blending what you knew before the hire with how they perform after, you can finally put a hard number on your team's ROI.

Breaking Down The Quality of Hire Formula

First, you need a flexible formula. A common mistake is trying to create a one-size-fits-all equation for the entire company. The markers of a great sales executive are completely different from those of a top-tier software engineer.

A solid, customizable QoH formula usually pulls from a few key inputs. Think of it like a balanced scorecard:

- First-Year Performance Review Score: Your most direct measure of success, typically on a scale like 1-5 or 1-100.

- 90-Day Manager Satisfaction Score: A quick pulse-check survey sent to the hiring manager rating the new hire on ramp-up time, skills, and overall fit.

- First-Year Retention: Did they stick around for at least 12 months? A simple Yes/No metric (or 1/0 for scoring).

- Pre-Hire Assessment Score: Data from technical tests, cognitive assessments, or even the scorecards from your structured interviews.

When you combine these, you get a clear, data-backed score that tells you how successful each hire actually was. We get into the nitty-gritty of building your own formula in our complete guide to Quality of Hire.

Establishing Internal and External Benchmarks

Once you have your formula, a score of "85" is meaningless without context. Start by calculating the QoH for everyone you hired in the last 12-24 months. This gives you an internal benchmark; it shows you what "good" actually looks like at your company.

This is where the real insights surface. You can slice the data to answer powerful questions:

- What's the average QoH for hires from employee referrals versus job boards?

- Do hires sourced by a specific recruiter consistently score higher?

- Is there a connection between high scores in the final interview and high scores on the first performance review?

The chart below breaks down how different components add up to a final QoH score.

A simple visual like this makes it obvious that factors like retention are having a huge positive impact on overall talent quality.

Creating A Sample Scoring Rubric

Let's bring this all together with a practical, weighted rubric that your whole team can use consistently.

Imagine a new hire and score them:

- Performance Score (50% weight): The new hire earned a 4 out of 5 on their annual review. (Score: 4/5 = 0.8)

- Manager Satisfaction (30% weight): The hiring manager rated them a 90 out of 100. (Score: 90/100 = 0.9)

- First-Year Retention (20% weight): The employee stayed for the entire year. (Score: 1/1 = 1.0)

Now for the math:

(0.8 * 50) + (0.9 * 30) + (1.0 * 20) = 40 + 27 + 20 = 87

This hire has a QoH score of 87. When you apply this rubric to every hire, you can start tracking trends, proving your team's value, and making smarter, data-driven decisions that elevate the quality of talent across the entire organization.

How Do You Measure Employee Retention and Internal Mobility?

Getting incredible people to join your company is a huge investment. The real measure of your talent strategy is whether you can keep them and help them grow. This is where retention and internal mobility come in. These two talent management metrics are deeply connected, and together, they paint a clear picture of your company culture's health and the long-term strength of your workforce.

Moving Beyond Basic Turnover Rates

To get a real sense of what's happening, you need to break down your retention data. This helps you see the difference between healthy turnover (like underperformers leaving) and departures that are actively hurting the business.

These are the retention metrics that actually tell you something useful:

- Regrettable Turnover: This is the big one—it tracks when your top performers decide to leave voluntarily. Losing these folks creates knowledge gaps, sucks the leadership potential out of your teams, and can cost up to 200% of their annual salary to replace.

- First-Year Attrition: This metric keeps an eye on the percentage of new hires who are gone within their first 12 months. If this number is high, it’s a massive red flag.

It's worth looking at companies that get this right. For example, understanding how Nintendo has achieved a 98% employee retention rate offers some incredible lessons. Their success shows just how powerful it is to build an environment where people feel valued and can see a real future for themselves.

The Power of Internal Mobility

Retention tells you if you can keep your people. Internal mobility tells you if you can grow them. It’s one of the strongest predictors of employee engagement and a healthy succession pipeline.

The Internal Mobility Rate (IMR) is your go-to metric here. Calculating it is simple:

Internal Mobility Rate (IMR) = (Total Number of Internal Hires / Total Number of Hires) x 100

A high IMR is a sign of a healthy, developing workforce. It also has a ripple effect across the entire business, lowering recruiting costs and drastically cutting down the time-to-fill for senior roles. This creates a self-sustaining talent cycle where you keep your best people by giving them new challenges. Check out how to get started with internal talent rediscovery.

How To Build a Talent Metrics Dashboard That Tells a Story?

Raw data is just noise. A truly strategic talent metrics dashboard does more than just throw numbers on a screen; it weaves them into a story that justifies your team's budget, flags hidden opportunities, and gets executives to act.

The goal is to stop building data dumps and start designing a narrative. A CEO doesn’t care about the same details as a frontline recruiter. The best dashboards are layered, with each view answering specific questions for a specific person.

The Strategic C-Suite View

For the executive team, your dashboard needs to connect talent directly to the bottom line. They think in terms of ROI, risk, and competitive advantage.

Here's what they need to see:

- Quality of Hire (QoH): Frame it as, "Are the people we're hiring actually driving revenue and innovation?"

- High-Performer Retention: Present it as, "Are we keeping our most critical people?" A dip here is an immediate red flag.

- Overall Labor Cost as a Percentage of Revenue: This ties your talent strategy directly to the company's financial health.

The Operational TA Leadership View

Talent acquisition leaders need a clear view of the entire recruiting engine's health. They're focused on efficiency, pipeline health, and the effectiveness of their team.

The core metrics for TA leaders should include:

- Pipeline Velocity: How fast are candidates moving through each stage? This reveals bottlenecks before they derail hiring goals.

- Source Effectiveness by QoH: "Which of our sourcing channels deliver people who actually perform well and stick around?"

- Team Performance Metrics: Req load per recruiter and average time-to-fill by department.

The Tactical Recruiter View

For individual recruiters, the dashboard isn't a report—it's a daily toolkit. The data needs to be real-time and immediately actionable. Our guide to building a great reporting and analytics dashboard has practical tips.

Essential metrics for a recruiter’s dashboard are:

- Candidate Response Rates: Is my outreach actually working? This is a direct feedback loop on messaging and targeting.

- Interview-to-Offer Ratio: A clear measure of how well a recruiter understands the role.

- Time in Stage: How long are my candidates waiting for feedback?

By tailoring your talent management metrics dashboard to each of these audiences, you stop just reporting data. You start driving decisions.

How Do You Turn Talent Insights Into Business Strategy?

Tracking talent management metrics isn't an academic exercise—it's about using data to spot problems, predict hiring needs, and make decisions that push the business forward. This is where talent leaders become true strategic partners.

For in-house teams, metrics justify budgets and shape company-wide strategy. They provide the hard evidence to shift from reactive hiring to building a proactive talent pipeline.

Insights from the Global Talent Competitiveness Index 2023 show that top countries attract talent with better promotion prospects and higher wages. For companies, this isn't just trivia; it's a roadmap. This data directly shapes global recruitment strategies, relocation packages, and where to invest in talent development. You can explore more global talent insights on weforum.org.

For recruiting agencies, insightful talent management metrics are what separate you from being just another vendor. Your clients need market intelligence that gives them an edge. Stop just sending a list of candidates. Start delivering a data-driven story. By presenting hard data on where candidates get stuck, you can help clients streamline their recruitment process, improving the candidate experience and preventing top talent from dropping out.

This completely changes the conversation. You’re no longer just filling a job order. You’re providing critical market intelligence that helps your client win the war for talent.

Conclusion: The New Mandate for Talent Teams

The era of talent acquisition as a purely operational function is over. Simply tracking activity metrics is no longer enough to justify your team's existence or budget.

The new mandate is to operate as a strategic business partner, armed with data that proves a direct line between your talent efforts and the company’s bottom line.

By embracing a framework built on strategic talent management metrics—centered around Quality of Hire, High-Performer Retention, and Internal Mobility—you move beyond the "how fast" and into the "how well." This data-driven approach unlocks the ability to not just fill roles, but to build a more resilient, innovative, and high-performing organization from the inside out.

See how recruiters Juicebox to hire top talent, faster. Sign up now.

FAQs: Talent Management Metrics (2026)

What are the most important talent management metrics to track?

Focus on metrics that tie directly to business goals. The most critical are Quality of Hire (QoH), High-Performer Retention, and Internal Mobility Rate. These prove HR's impact on revenue and growth.

How can we measure Quality of Hire accurately?

Use a weighted index that blends pre-hire signals with post-hire performance. A common formula combines first-year performance review scores (50%), manager satisfaction (30%), and first-year retention (20%).

How do I get started if we aren't tracking any metrics?

Start small with data you already have. Employee Retention Rate or First-Year Attrition are great starting points from your HRIS. This builds momentum and shows value quickly without overwhelming your team.

How often should we review our talent management metrics?

Your reporting cadence should match your audience. Tactical metrics for recruiters are weekly. Operational metrics for TA leaders are monthly. Strategic metrics like QoH for the C-suite should be quarterly.